Part one is an ex-post update on whether my portfolio was as robust to Brexit as I hoped it would be in my last post. This is based on market moves on Friday; of course things will continue to move as the full ramifications are digested.

Part two explains how Brexit was a classic negative skew event in more ways than one, how behavioural finance can help explain that, how it was mispriced by the markets, and how I used that information to make a little bit of money.

|

| Say hello to our next Prime Minister. Source: The Sun |

Did I survive Brexit?

Yes.

Let me expand.

Trading in GBPUSD

I made no money at all trading cable, the asset most exposed to Brexit. In fact I lost some. When I wrote my last post I had no position in GBPUSD IMM futures. However the swings in sterling sentiment were reflected in first a sell:

11242 GBP 201609 2016-06-15 02:38:16 -1 1.412600

And then I closed that as GBP went stronger in the post Jo-Cox* bounce in remains polling figures.

* It feels wrong to be talking about her tragic death in a grubby post which is mainly, at least at the moment, about money. However it seems likely that what happened to her was clearly linked to the referendum campaign. I had the privilege of briefly seeing her in person. She was on the select committee which I appeared before last year (16:20:00 on the timestamp of the video feed onwards), and I was very impressed with her performance. I'll be doing the politics of this later.

11296 GBP 201609 2016-06-17 18:54:08 1 1.434800

As with a typical trend following system in a range bound market I sold low and bought high. And a further opening buy almost exactly 24 hours before the result would become clear, as the world decided remain was a shoe in (more about this below).

11461 GBP 201609 2016-06-23 02:51:41 1 1.483000

Then, of course it all went wrong. The pound got smashed. With a reversing price and volatility going through the roof, the system closed out it's position.

11509 GBP 201609 2016-06-24 03:54:26 -1 1.366400

Although the price continued to collapse it to around 1.33 then recovered, and closed at pretty much the same level. As I'm writing this the pound is drifting lower, but I have no position to take advantage of this.

I lost the equivalent of nearly 2% of my portfolio on that one lousy GBP contract, about 1.25% of which was lost on the day.

The rest of my futures portfolio

Fortunately, as I said in my last post:

"It doesn't even look like a strong "risk on" or "risk off" theme, though I look to be a little bit more "risk off"."

Yeah, I got that right. I made it all back on the rest of my portfolio. In order of importantce: US bonds and Eurodollar, German bonds (makes sense), Korean bonds (who'd have though it - Korea a safe haven from the UK...), French bonds (the irony) and JPYUSD (though I gave that all back on AUDUSD).

I had no position in Gold, but you can't have everything.

I lost a bit on short positions in VIX and V2X.

Net-net on the main futures portfolio I made a little under 2.5%. Not as much as Crispin Odey is supposed to have made, but then I would imagine he would have hurt a lot more than me if the result had been as expected.

The point here isn't so much "ooh look I made money isn't my system clever" - it is pure luck how much anyone makes on a single day, but that my risk was well managed, such that a 6 sigma event in the markets translated into roughly a 2 sigma portfolio move based on my expected risk going into the vote.

Equities, currency and hedging

Again, from the post:

As I've said before my futures trading account is funded by a long stock position, which is in a mixture of UK stocks and a European ETF IDVY; hedged by a Eurostoxx futures short. This is a more interesting little portfolio; ignoring the effects on stocks if the pound gets hammered then in GBP terms this portfolio will go up in value - there will be a gain in the value of the ETF but the futures hedge won't move since it's unaffected by currency movements.

I was close here. The Eurostoxx did get hammered, more than the FTSE so I got that wrong. However it did indeed lose less in GBP terms because of the devaluation. Also the UK shares I hold in this account didn't do half badly. Net-net the long stocks plus hedge added another 2% or so.

I also have a long only, buy and hold, portfolio of UK stocks and ETF's covering bonds and equities across the globe.

Here are some more quotes from my Brexit post:

The ETF's are not currency hedged, so a GBP devaluation following brexit would benefit them

This is exactly what happened. The only ETF in my main portfolio that fell in £ terms was a high yield Eurostoxx beast, which suffered from the huge fall in banking shares which wiped out the EURGBP revaluation benefit. All my other ETF's were up in £ terms.

The effect on stocks is a little tricker to predict, but I would imagine my UK stocks would hurt - perhaps 5% at worse? A huge one day drop which will probably be partly reversed, but not the end of the world.

The FTSE100 was down 3.2% at the close, the FTSE 250 7.2%. So on average 5% was a good guess. Some of my UK stocks did much better (Glaxo was up), others much worse (Intermediate Capital Group was done over 14%).

Overall in my long only account I was flat.

This isn't genius trading, but at least if the book sales fall short then I could probably get a job as a risk analyst.

All of this is on a T+1 analysis. We don't really know how things will pan out over the next N years whilst this little mess gets sorted out.

Brexit as negative skew

Cameron, David

I tweeted a lot on Friday. Here is one of my first efforts:

https://twitter.com/investingidiocy/status/746240000073728000

"Cameron took on the classic short vol trade - high probability of success, small upside, huge downside. And lost. #brexit"

That is pretty self explanatory. Cameron acted like a muppet running a hedge fund.

Your typical muppet HF manager will keep selling OTM options. They kept expiring without value, leaving him with the premium. He begins to confuse luck with skill; he thinks he was invincible. This is the classic behavioural finance effect of overconfidence. Then one day, he blows up.

Why was the referendum like an OTM option?

Firstly, it looked like a forgone conclusion. Promising a referendum was a cheap way to beat down the nascent UKIP vote in last years election (the vote still hit historic highs, but thanks to our bonkers electoral system they were unable to achieve concentrated support to win more than one seat in parliament). It would be so easy, just a half baked (and suspiciously quick) negotiation with the EU to get superficial concessions, hold the referendum, bish-bash-bosh with the handy side effect of destroying his main political rival (By which I mean Boris Johnson. Not the labour party).

Yes there were some tense moments, but he never looked ruffled, or looked like he ever thought he would lose. This looked like a high probability event, but the downside, which doesn't seem to have been properly considered, was enormous - both politically and personally.

Secondly, it had a small payoff if it succeeded. Without the referendum I think it is incredibly unlikely that Boris would be a serious contender for PM.

Thirdly it had a large cost if it went wrong. Both personally, politically and economically.

Overconfidence often seems to affect people from privileged backgrounds.

The whole country is paying for the fact that Cameron has had a smooth path through life with nothing going really wrong. There are many articles in the press pointing out how he's been lucky with several political gambles over the years. Even having to go into coalition with the Lib Dems was a blessing, giving him an excuse to keep the right wing of the party at bay whilst holding Nick Clegg in front of himself to take all the flak for the politics of austerity.

All this made him think he was invincible. Similar (dare I say?) to the careers of many financial traders and asset managers, many of whom come from privileged backgrounds and who sailed through life without failing at anything*, who confused luck with skill, became infected with the fatal disease of hubris; before the inevitable blow up.

* Full disclosure: The author of this blog was privately educated and was admitted to the worlds best university (the first generation in his family to go on to higher education, make of that what you will), but soon found he wasn't as clever as he thought he was, and left after one year. A series of random unconnected jobs followed. On first coming into contact with the financial sector with a job as a trader he hated it. So yes, I've been lucky, to have screwed up my life royally many many times.

Finally both hedge fund managers and David Cameron have the advantage of a fairly soft landing if things go wrong. Collecting 2 and 20 for a few years on a few hundred million or more can set you up for life. Cameron has more than enough personal wealth, his wife still works, and even with his ignominious exit could easily rack up a few million quid a year "advising" banks and private equity firms (a case of "don't do as I did, do as I say"?).

A fair payoff for negative skew

Now, taking negative skew bets isn't automatically a bad thing, if they're fairly priced. The minimum one should accept is something that gives you zero expectation. Ideally you'd get more than this, a lot more, since most reasonably people have a utility function that hates negative skew.

So if the probability of an event is P, and the payoff is a, with a loss of b if the event doesn't happen:

b>a (definition of negative skew)

aP > (1-P)b

NOT a black swan. A white one with one grey feather

Before I continue, I'll just point out that Brexit was NOT a black swan - an inconceivable event with a tiny probability of happening. Even at the widest odds the implied probability of the event was more than 10%.

The City, The Bookmakers and The Polls

It wasn't just Cameron who got the probability of this event wrong, it was everyone.

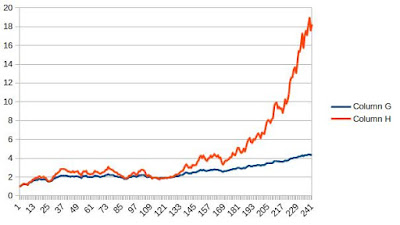

On the day before the referendum implied currency volatility was pricing in something like a 20% chance of Brexit happening:

"@investingidiocy on BBG, prob derived from FX options for leave is 19% - but guessing the spread is huge to do the arb trade!!!"

twitter with thanks to Saeed Amen

Similarly on the betting markets the decimal odds on betfair were also implying roughly a 20% chance, although this was moving around (see image - not up to date, but gives you an idea of the volatility)

It was clear to me that 20% was far too low. See these opinion polls.

Notice that:

Personally I thought on Thursday that given the final poll of polls figure of 48:46, with undecided at 6%, and an MOE of a couple of percent.... well this wasn't an event with just a 20% chance of happening. It was pretty close to a coin flip; but let's call the odds of remain P=60%. But the ratio of the two payoffs in the betting market was more than 5.0 (decimal odds of 1.2 and 6.0 respectively). So the expectation of the two options is:

0.6 x 1.2 = 0.72

0.4 x 6.0 = 2.4

The second option (betting on leave) is clearly more attractive than the second.

Why this apparent mispricing? Well the markets (betting and FX) move depending on weight of money. Mostly wealthy well educated people of a higher social class play in both markets. Exactly the sort of people who voted remain. They ignored the polls and focused on their own prejudices. Again this is behavioural finance at work. Could be one of several effects, but lets go with narrative bias. The "story" that Brexit was terrible and nobody would vote for it was more attractive than the statistical evidence in the polls.

That is the specific effect. But generally people are really bad at understanding data when measured with uncertainty; and this is particularly dangerous when the outcome is binary - people will naturally try and assign probabilities of 100% and 0% to binary options.

It was clear to me that 20% was far too low. See these opinion polls.

|

| Source: Financial Times |

Notice that:

- The vote was on a knife edge; with neither side getting a clear advantage (say 60:40) in any poll

- There is considerable variation across time

- There is considerable variation across polls

- The undecided figure, although narrowing over time, was still averaging about 6% at the end - easily enough to swing it one way or another.

- Polls have margins of error (MOE), which are shamefully absent from public discourse. Most polls of the size done in the referendum campaign would have MOE of 3-5%. Polls of polls have a smaller MOE; maybe a couple of percent.

Personally I thought on Thursday that given the final poll of polls figure of 48:46, with undecided at 6%, and an MOE of a couple of percent.... well this wasn't an event with just a 20% chance of happening. It was pretty close to a coin flip; but let's call the odds of remain P=60%. But the ratio of the two payoffs in the betting market was more than 5.0 (decimal odds of 1.2 and 6.0 respectively). So the expectation of the two options is:

0.6 x 1.2 = 0.72

0.4 x 6.0 = 2.4

Why this apparent mispricing? Well the markets (betting and FX) move depending on weight of money. Mostly wealthy well educated people of a higher social class play in both markets. Exactly the sort of people who voted remain. They ignored the polls and focused on their own prejudices. Again this is behavioural finance at work. Could be one of several effects, but lets go with narrative bias. The "story" that Brexit was terrible and nobody would vote for it was more attractive than the statistical evidence in the polls.

That is the specific effect. But generally people are really bad at understanding data when measured with uncertainty; and this is particularly dangerous when the outcome is binary - people will naturally try and assign probabilities of 100% and 0% to binary options.

My little flutter

So how best to exploit this? A straightforward way would be to sell GBP eithier in USD or EUR. Or do the same thing via options, although note that buying OTM options is an expensive business due to the spread. You could also bet on the outcome.

However although all of these bets have positive expectation, it will also on average lose money (assuming there was say a 60% chance of remain). Since we can only bet on brexit once this is somewhat annoying.

I opted for a combination trade (and here); a bet on Betfair on Brexit, and a purchase of GBP against EUR (so a bet on remain). I sized the latter trade so that my expected payout in the event of eithier remain or leave would be the same.

Actually I probably got the size wrong. I doubt that GBPEUR would have rallied enough with a remain vote to make up for my loss on Betfair. The resulting depreciation of GBPEUR was also relatively small; as it turned out Brexit is bad for Europe as well and all the capital fleeing to safe havens went to America - it was GBPUSD that really got crucified.

However although all of these bets have positive expectation, it will also on average lose money (assuming there was say a 60% chance of remain). Since we can only bet on brexit once this is somewhat annoying.

I opted for a combination trade (and here); a bet on Betfair on Brexit, and a purchase of GBP against EUR (so a bet on remain). I sized the latter trade so that my expected payout in the event of eithier remain or leave would be the same.

Actually I probably got the size wrong. I doubt that GBPEUR would have rallied enough with a remain vote to make up for my loss on Betfair. The resulting depreciation of GBPEUR was also relatively small; as it turned out Brexit is bad for Europe as well and all the capital fleeing to safe havens went to America - it was GBPUSD that really got crucified.

As a result I ended up making much more than I expected (also here) on a leave vote. However this was a fun trade done for relatively small amounts of money. This kind of global macro discretionary trading isn't my forte. It seems like a lot of work.

Summary

Generally betting on a coin toss isn't a good idea, unless the market is mispricing the chances of heads as just 20%.

However these opportunities are few and far between, and require a lot of work and analysis. Systematic trading is far easier. A properly structured (diversified, risk managed) investment portfolio or trading system will not be vulnerable to shocks like Brexit.

So I made some money. I take absolutely no pleasure in this because I genuinely feel it was the wrong decision which will have, and already has had, terrible consequences (both economically, and in a sharp rise in racism). There is already discussion that Brexit may never actually happen; I hope this is the case.