This is the sixth (!) post in a (loosely defined) series about finding the best way to trade futures with a relatively small account size.

- This first (old) post, which wasn't conciously part of a series, uses an 'ugly hack': a non linear rescaling of forecasts such that we only take positions for relatively large forecast size. This is the method I was using for many years.

- These two posts (first and second) discuss an idea for dynamic optmisation of positions. Which doesn't work.

- This post discusses a static optimisation method for selecting the best set of instruments to include in a system given limited capital. This works! This is the method I've been using more recently.

- Finally, in the last post I go back to dynamic optimisation, but this time using a simpler heuristic method. Again, this didn't work very well.

(Incidentally, if you're new to this problem, it's probably worth reading the first post on dynamic optimisation post in my series

That would be the end of the story, apart from the fact that I got a mysterious twitter reply:

Rob - I have found good results on this exact problem by minimizing tracking error and trade cost vs optimal “fractional” portfolio, without considering AT ALL the objective that created the fractional portfolio. Happy to chat if helpful.

— Doug Hohner (@DougHohner) July 27, 2021

UPDATE (22nd October 2021)

It didn't work, at least not as well as I'd hoped.

After writing this post and implementing the idea in production I found some issues in my backtesting results were producing misleading results (in short my cost calculations were not appropriate for a system with 'sparse' positions - there is more detail here).

I could rewrite this post, but I think it's better to leave it as a monument to my inadequacy. I'm working on an alternative version of this method that I hope will work better.

What was Doug's brilliant idea

Doug's idea had two main insights:

- It's far more stable to minimise the variance of the tracking error portfolio, rather than using my original idea (maximising the utility of the target portfolio, having extracted the expected return from the optimal portfolio). And indeed this is a well known technique in quant finance (people who run index funds are forever minimising tracking error variance).

- A grid search is unneccessary given that in portfolio optimisation we usually have a lot of very similar portfolios, all of which are equally as good, and finding the global optimum doesn't usually give us much value. So using a greedy algorithm is a sufficiently good search method, and also a lot faster as it doesn't require exponentially more time as we add assets.

|

| Mr Greedy https://mrmen.fandom.com/wiki/Mr._Greedy?file=Mr_greedy_1A.png |

Here's the core code (well my version of Doug's R code to be precise):

def greedy_algo_across_integer_values(

obj_instance: objectiveFunctionForGreedy

) -> np.array:

## Starting weights

## These will eithier be all zero, or in the presence of constraints will include the minima

weight_start = obj_instance.starting_weights_as_np()

## Evaluate the starting weights. We're minimising here

best_value = obj_instance.evaluate(weight_start)

best_solution = weight_start

done = False

while not done:

new_best_value, new_solution = _find_possible_new_best(best_solution = best_solution,

best_value=best_value,

obj_instance=obj_instance)

if new_best_value<best_value:

# reached a new optimium (we're minimising remember)

best_value = new_best_value

best_solution = new_solution

else:

# we can't do any better (or we're in a local minima, but such is greedy algorithim life)

break

return best_solution

def _find_possible_new_best(best_solution: np.array,

best_value: float,

obj_instance: objectiveFunctionForGreedy) -> tuple:

new_best_value = best_value

new_solution = best_solution

per_contract_value = obj_instance.per_contract_value_as_np

direction = obj_instance.direction_as_np

count_assets = len(best_solution)

for i in range(count_assets):

temp_step = copy(best_solution)

temp_step[i] = temp_step[i] + per_contract_value[i] * direction[i]

temp_objective_value = obj_instance.evaluate(temp_step)

if temp_objective_value < new_best_value:

new_best_value = temp_objective_value

new_solution = temp_step

return new_best_value, new_solution

Hopefully that's pretty clear and obvious. A couple of important notes:

- The direction will always be the sign of the optimal position. So we'd normally start at zero (start_weights), and then get gradually longer (if the optimal is positive), or start at zero and get gradually shorter (if the optimal position is a negative short). This means we're only ever moving in one direction which makes the greedy algorithim work. Note: This is different with certain corner cases in the presence of constraints. See the end of the post.

- We move in steps of per_contract_value. Since everything is being done in portfolio weights space (eg 150% means the notional value of our position is equal to 1.5 times our capital: see the first post for more detail), not contract space, these won't be integers; and the per_contract_value will be different for each instrument we're trading.

Let's have a little look at the objective function (the interesting bit, not the boilerplate). Here 'weights_optimal_as_np' are the fractional weights we'd want to take if we could trade fractional contracts:

class objectiveFunctionForGreedy:

....

def evaluate(self, weights: np.array) -> float:

solution_gap = weights - self.weights_optimal_as_np

track_error = \

(solution_gap.dot(self.covariance_matrix_as_np).dot(solution_gap))**.5

trade_costs = self.calculate_costs(weights)

return track_error + trade_costs

def calculate_costs(self, weights: np.array) -> float:

if self.no_prior_weights_provided:

return 0.0

trade_gap = weights - self.weights_prior_as_np

costs_per_trade = self.costs_as_np

trade_costs = sum(abs(costs_per_trade * trade_gap * self.trade_shadow_cost))

return trade_costs

The tracking error portfolio is just the portfolio whose weights are the gap between our current weights and the optimal unrounded weights, and what we are trying to minimise is the standard deviation of that portfolio.

The covariance matrix used to calculate the standard deviation is the one for instrument returns (not trading subsystem returns); if you've followed the story you will recall that I spent some time grappling with this decision before and I see no reason to change my mind. For this particular methodology the use of instrument returns is a complete no-brainer.

The shadow cost is required because portfolio standard deviation and trading costs are in completely different units, so we can't just add them together. It defaults to 10 in my code (some experimentation reveals roughly this value gives the same turnover as the original system before the optimisation occurs. As you'll see later I haven't optimised this for performance).

Performance

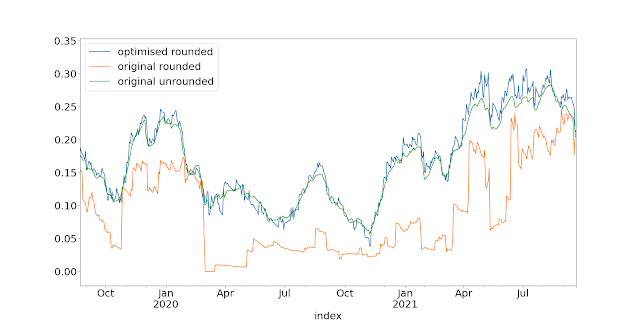

And let's have a look at some results (45 instruments, $100K in capital). All systems are using the same basic 3 momentum crossover+carry rules I introduce in chapter 15 of my first book.

So if we were able to take fractional positions (which we're not!) we could make the green line (which has a Sharpe Ratio of 1.17). But we can't take fractional positions! (sad face and a Sharpe Ratio of just 1.06). But if we run the optimiser, we can achieve the blue line, even without requiring fractional positions. Which has a Sharpe Ratio of .... drumroll... 1.19.

Costs? About 0.13 SR units for all three versions.

Tiny differences in Sharpe Ratio aside, the optimisation process does a great job in getting pretty close to the raw unrounded portfolio (correlation of returns 0.94). OK the rounded portfolio is even more correlated (0.97) , but I think that's a price worth paying.

That's a little higher than what you will have seen in previous backtests. The reason is I'm now including holding costs in my calculations. I plan to exclude some instruments from trading whose holding costs are a little high, which will bring these figures down, but for now I've left them in.

If I do a t-test comparing the returns of the three account curves I find that the optimised version is indistinguishable from the unrounded fractional position version. And I also find that the optimised version is significantly better than the rounded positions: a T-statistic of 3.7 with a tiny p-value. Since these are the versions we can actually run in practice, that is a stonking win for the optimisation.

Risk

The interesting thing about the greedy algorithm is that it gradually adds risk until it finds the optimal position, whilst trying to reduce the variance of the delta portfolio, so it should hopefully target similar risk. Here is the expected (ex-ante) risk for all three systems:

|

Red line: original system with rounded positions, Green line: original system with unrounded positions, Blue line: optimised system with unrounded positions |

It's quite hard to see what's going on there, so let's zoom into more recent data:

You can see that the optimiser does a superb job of targeting the required risk, compared to the systematically under-risked (in this period - sometimes it will be over-risked) and lumpy risk presented by the rounded positions. The ex-post risk over the entire dataset comes in at 22.4% (unrounded), 20.9% (rounded) and 21.6% (optimised); versus a target of 20%.

How many positions do we typically take?

An interesting question that Doug asked me is how many positions the optimiser typically takes.

"Curious how many positions it uses of the 45??

I guess I don’t know how much capital you are running, but given there are really only maybe 10 independent bets there (or not many more) does it find a parsimonious answer that you might use even if you had a giant portfolio to run?"

Remember we have 45 markets we could choose from in this setup, how many do we actually use?

|

| Blue line: Total number of instruments with data. Orange line: Instruments with positions from optimiser |

"Pretty cool. The dimension of the returns just isn’t all that high even though there are so many things moving around."

Interestingly, here are some statistics showing the % of time any given instrument has a position on. I've done this over the last 7 years, as otherwise it would be biased towards instruments for which we have far more data:

PALLAD 0.00

COPPER 0.00

GASOILINE 0.00

FEEDCOW 0.00

PLAT 0.00

HEATOIL 0.00

GBP 0.01

REDWHEAT 0.02

WHEAT 0.02

EUR 0.02

NZD 0.03

CRUDE_W_mini 0.03

US20 0.03

US10 0.03

SOYOIL 0.04

LEANHOG 0.04

AUD 0.04

LIVECOW 0.05

JPY 0.05

SOYMEAL 0.06

CAC 0.07

SOYBEAN 0.08

OATIES 0.08

OAT 0.09

RICE 0.10

US5 0.11

MXP 0.12

CORN 0.13

BTP 0.14

SMI 0.14

AEX 0.14

GOLD_micro 0.19

EUROSTX 0.23

KR10 0.24

BITCOIN 0.26

EU-DIV30 0.33

BUND 0.39

EDOLLAR 0.39

BOBL 0.43

NASDAQ_micro 0.47

VIX 0.55

SP500_micro 0.60

KR3 0.66

US2 0.73

SHATZ 0.74

Notice we end up taking positions in all but six instruments. And even if we never take a position in those instruments, their signals are still contributing to the information we have about other markets. Remember from the previous posts, I may want to include instruments in the optimisation that are too illiquid or expensive to trade, and then subsequently not take positions in them.

I've highlighted in bold the 16 instruments we trade the most. You might want to take the approach of only trading these instruments: effectively ignoring the dynamic nature of the optimisation and saying 'This is a portfolio that mostly reproduces the exposure I want'.

However notice that they're all financial instruments (Gold and Bitcoin, quasi financial), reflecting that the big trends of the last 7 years have all been financial. So we'd probably want to go further back. Here are the instruments with the most positions over all the data:

PLAT 0.24

RICE 0.25

CRUDE_W_mini 0.26

NASDAQ_micro 0.27

SOYMEAL 0.33

US2 0.35

US5 0.38

WHEAT 0.39

LIVECOW 0.40

LEANHOG 0.41

CORN 0.43

SOYOIL 0.44

EDOLLAR 0.46

SP500_micro 0.56

GOLD_micro 0.56

OATIES 0.61

That's a much more diversified set of instruments. But I still don't think this is the way forward.

Tracking error

Tracking error: I like to think of as quantified regret. Regret that you're missing out on trends in markets you don't have a full size position in...

What does the tracking error look like? Here are the differences in daily returns between the unrounded and optimised portfolio:

The standard deviation is 0.486%. It also looks like the tracking error has grown a little over time, but 2020 aside it has been fairly steady for a number of years. My hunch is that as we get more markets in the dataset it becomes more likely that we'll have fractional positions in a lot of markets that the optimiser can't match very well. And indeed, if I plot the tracking error of rounded versus unrounded portfolios, it shows a similar pattern. The standard deviation for that tracking error is also virtually identical: 0.494%.

Checking the cost effects

It's worth checking to see what effect the cost penalty is having. I had a quick look at Eurodollar, since we know from the above analysis that it's a market we normally have a position on. Zooming in to recent history to make things clearer:

The green line is the unrounded position we'd ideally want to have on, wheras the red line shows our simple rounded (and buffered) position. The blue line shows what the optimiser would do without a cost penalty. It trades - a lot! And the orange line shows our optimised position. It's trading a bit more than the red line, and interestingly often has a larger position on (where it's probably taking on more of the load of being long fixed income from other instruments), but it's definitely trading a lot less than the blue line.

Interestingly the addition of the cost penalty doesn't reduce backtested costs much, and reduces net performance a little: about 1 SR point, but I'd still rather have the penalty thanks very much.

Much lower capital

To ssee how robust this approach is, let's repeat some of the analysis above with just 50K in capital.

So the optimised version is still better than the rounded (SR improvement around 0.1), but nowhere near as good as the unrounded (SR penalty around 0.2). We can't work miracles! With 50K we just don't have enough capital to accurately reflect the exposures we'd like to take in 45 markets. The tracking error vs the unrounded portfolio is 0.72% for the optimiser (versus 0.49% earlier with 100K), but is even higher for the rounded portfolio (0.76%). The correlation between the optimiser and ideal unrounded optimal returns has dropped to 0.86 (0.94 with 100K); but for rounded positions is even lower: 0.84 (0.97 with 100K).

Less capital makes it harder to match the unrounded position of a large portfolio of instruments, but relatively speaking the dynamic optimisation is still the superior method.

Important note: With

What does this mean?

Let's just review what our options are if we have limited capital, of say $100K:

- We could win the lottery and trade the unrounded positions.

- We could try and trade a lot of instruments - say 45 - and just let our positions be rounded. This gives us a SR penalty of around 0.1 SR versus what we could do with unrounded positions. The penalty would be larger (in expectation) with less capital and / or more instruments (eg it's 0.3SR with 50k). The tracking error would also get larger for smaller capital, relative to the number of instruments.

- We could try and choose a set of static instruments and just trade those. In this post I showed that we could probably choose 16 instruments using a systematic approach. This would also give us a SR penalty of around 0.1 SR in expectation, but the tracking error would be larger than for rounded positions. Again with less capital / more instruments both penalties and tracking error would be larger.

- We could use the 'principal components' approach, to choose a static list of the 16 instruments that are normally selected by the optimiser. I've highlighted these in the list of instruments above. Our tracking error would be a little smaller (in expectation) than for rounded positions, but we'd still have a SR penalty of around 0.1 SR.

- We could have as many instruments as we liked in our portfolio and use the dynamic optimisation approach to decide which of those to hold positions for today. Normally this means we'll only have positions in around 10 instruments or so, but the 10 involved will change from day to day. Our tracking error would be similar as for rounded positions, but we'd not be giving up much in terms of SR (if anything). With smaller capital or more instruments we'd get some SR penalty (but less than the alternatives), and higher tracking error (but again better than the alternatives).

Ignoring the first option, it strikes me that dynamic optimisation brings significant benefits, which for me overcome the additional complexity it introduces into our trading.

Live trading

If you're clever, you will have noticed that the algo code above doesn't include any provision for some of the features I specified in my initital post on this subject:

- A 'reduce only' constraint, so I can gradually remove instruments which no longer meet liquidity and cost requirements

- A 'do not trade' constraint, if for some reason

- Maximum position constraints (which could be for any reason really)

The psystemtrade version of the code here covers these possibilities. It adjusts the starting weights and direction depending on the constraints above, and also introduces minima and maxima into the optimisation (and prevents the greedy algorithim from adjusting weights any further once they've hit those). It's a bit complicated because there are quite a few corner cases to deal with, but hopefully it makes sense.

Note: I could use a more exhaustive grid search for live trading, which only optimises once a day, but I wouldn't be able to backtest it with 100+ instruments so I'll stick with the greedy algorithim, which also has the virtue of being a very robust and stable process and avoids duplicating code.

Let's have a play with this code and see how well it works. Here's what the optimised positions are for a particular day in the data. In the first column is the portfolio weight per contract. The previous days portfolio weights are shown in the next column. The third column shows the optimal portfolio weights we'd have in the absence of rounding. The optimised positions are in the final column. I've sorted by optimal position, and removed some very small weights for clarity:

per contract previous optimal optimised

SHATZ 1.32 -10.56 -3.08 -5.27

BOBL 1.59 -1.59 -1.09 0.00

OAT 1.97 0.00 -0.31 0.00

VIX 0.24 0.00 -0.14 -0.24

EUR 1.47 0.00 -0.13 0.00... snip...

GOLD_micro 0.18 0.00 -0.01 -0.18

... snip...

AEX 1.84 1.86 0.12 0.00

EUROSTX 0.48 0.00 0.13 0.48

EU-DIV30 0.22 0.22 0.14 0.00

MXP 0.25 0.00 0.16 0.00

US10 1.33 1.33 0.17 1.33

SMI 1.27 0.00 0.19 0.00

SP500_micro 0.22 0.00 0.21 0.00

US20 1.64 0.00 0.23 0.00

NASDAQ_micro 0.30 0.31 0.26 0.30

US5 1.23 2.47 0.33 2.47

KR10 1.07 0.00 0.41 0.00

BUND 2.01 0.00 0.91 0.00

EDOLLAR 2.47 0.00 1.44 0.00

KR3 0.94 3.77 2.96 3.77

US2 2.20 8.81 17.44 8.81

Now let's suppose we could only take a single contract position in US 5 year bonds, which is a maximum portfolio weight of 1.23:

weight per contract previous optimal optimised with no trade

SHATZ 1.32 -10.56 -3.08 -5.27 -2.63

BOBL 1.59 -1.59 -1.09 0.00 0.00

OAT 1.97 0.00 -0.31 0.00 0.00

VIX 0.24 0.00 -0.14 -0.24 -0.24

... snip...GOLD_micro 0.18 0.00 -0.01 -0.18 0.00

... snip...AEX 1.84 1.86 0.12 0.00 0.00

EUROSTX 0.48 0.00 0.13 0.48 0.48

EU-DIV30 0.22 0.22 0.14 0.00 0.00

MXP 0.25 0.00 0.16 0.00 0.00

US10 1.33 1.33 0.17 1.33 1.33

SMI 1.27 0.00 0.19 0.00 0.00

SP500_micro 0.22 0.00 0.21 0.00 0.00

US20 1.64 0.00 0.23 0.00 0.00

NASDAQ_micro 0.30 0.31 0.26 0.30 0.30

US5 1.23 2.47 0.33 2.47 1.23

KR10 1.07 0.00 0.41 0.00 0.00

BUND 2.01 0.00 0.91 0.00 0.00

EDOLLAR 2.47 0.00 1.44 0.00 0.00

KR3 0.94 3.77 2.96 3.77 3.77

US2 2.20 8.81 17.44 8.81 8.81

That works. Notice that to compensate we reduce our short in two correlated market (German 2 year bonds and Gold, both of which have correlations above 0.55); for some reason this is a better option that increasing our long position elsewhere.

Now suppose we can't currently trade German 5 year bonds, Bobls, (but we remove the position constraint):

weight per contract previous optimal optimised with no trade

SHATZ 1.32 -10.56 -3.08 -5.27 -2.63

BOBL 1.59 -1.59 -1.09 0.00 -1.59

OAT 1.97 0.00 -0.31 0.00 0.00

VIX 0.24 0.00 -0.14 -0.24 -0.24

... snip...GOLD_micro 0.18 0.00 -0.01 -0.18 -0.18

... snip ...AEX 1.84 1.86 0.12 0.00 0.00

EUROSTX 0.48 0.00 0.13 0.48 0.48

EU-DIV30 0.22 0.22 0.14 0.00 0.00

MXP 0.25 0.00 0.16 0.00 0.00

US10 1.33 1.33 0.17 1.33 2.66

SMI 1.27 0.00 0.19 0.00 0.00

SP500_micro 0.22 0.00 0.21 0.00 0.00

US20 1.64 0.00 0.23 0.00 0.00

NASDAQ_micro 0.30 0.31 0.26 0.30 0.30

US5 1.23 2.47 0.33 2.47 1.23

KR10 1.07 0.00 0.41 0.00 0.00

BUND 2.01 0.00 0.91 0.00 0.00

EDOLLAR 2.47 0.00 1.44 0.00 0.00

KR3 0.94 3.77 2.96 3.77 3.77

US2 2.20 8.81 17.44 8.81 8.81

Our position in Bobl remains the same, and to compensate for the extra short we go less short 2 year Shatz, longer 10 year German bonds (Bunds), and there is also some action in US 5 year and 10 year bonds.

Finally consider a case when we can only reduce our position. There are a limited number of markets where this will do anything in this example, so let's do it with Gold and Eurostoxx (which the previous day have zero position, so this will be equivalent to not trading)

weight per contract previous optimal optimised reduce only

SHATZ 1.32 -10.56 -3.08 -5.27 -5.27

BOBL 1.59 -1.59 -1.09 0.00 0.00

OAT 1.97 0.00 -0.31 0.00 0.00

VIX 0.24 0.00 -0.14 -0.24 -0.24

EUR 1.47 0.00 -0.13 0.00 0.00

... snip ...GOLD_micro 0.18 0.00 -0.01 -0.18 0.00

... snip ...EUROSTX 0.48 0.00 0.13 0.48 0.00

EU-DIV30 0.22 0.22 0.14 0.00 0.22

MXP 0.25 0.00 0.16 0.00 0.00

US10 1.33 1.33 0.17 1.33 1.33

SMI 1.27 0.00 0.19 0.00 0.00

SP500_micro 0.22 0.00 0.21 0.00 0.22

US20 1.64 0.00 0.23 0.00 0.00

NASDAQ_micro 0.30 0.31 0.26 0.30 0.30

US5 1.23 2.47 0.33 2.47 1.23

KR10 1.07 0.00 0.41 0.00 0.00

BUND 2.01 0.00 0.91 0.00 0.00

EDOLLAR 2.47 0.00 1.44 0.00 0.00

KR3 0.94 3.77 2.96 3.77 3.77

US2 2.20 8.81 17.44 8.81 8.81

Once again the exposure we can't take in Eurostoxx is pushed elsewhere: into EU-DIV30 (another European equity index) and S&P 500; the fact we can't go as short in Gold is compensated for by a slightly smaller long in US5 year bonds.

What's next

I've prodded and poked this methodology in backtesting, and I'm fairly confident it's working well and does what I expect it to. The next step is to write an order generation layer (the bit of code that basically takes optimal positions and current live positions, and issues orders: that will replace the current layer, which just does buffering), and develop some additional diagnostic reports for live trading (the sort of dataframes in the section above would work well, to get a feel for how maxima and minima are affecting the results). I'll then create a paper trading system which will include the 100+ instruments I currently have data for.

At some point I'll be ready to switch my live trading to this new system. The nice thing about the methodology is that it will gradually transition out of whatever positions I happen to have on into the optimal positions, so there won't be a 'cliff edge' effect of changing systems (I might impose a temporarily higher shadow cost to make this process even smoother).

In the mean time, if anyone has any ideas for further diagnostics that I can run to test this idea out I'd be happy to hear them.

Finally I'd like to thank Doug once again for his valuable insight.