Following the mind numbing detail of the performance analysis there are some concluding thoughts on life, the universe, and everything pertaining to systematically investing / trading for a living.

Investments and benchmarking

My investments fall into the following categories:

- In my investment accounts:

- UK stocks

- Various ETFs, covering stocks, bonds, and gold

- In my trading account:

- Various ETFs, covering stocks and bonds

- A futures contract hedge against those long only ETFs in 2.1, so that the net Beta is around zero

- Futures contracts traded by my fully automated trading system

- Cash needed for futures margin, and to cover potential trading losses (there is also some cash in my investment accounts, but it's pretty much a rounding error)

I'm excluding from this analysis the value of our house (and any debt secured against it), defined benefit pensions, and my 'cash float' - roughly 3 months of household expenditure that I keep segregated away from my brokerage accounts. Anyone who is living wholly or partly off investment income would do well to keep a similar float, as dividends do not arrive in smooth lumps throughout the year.

For the purposes of benchmarking it's then convenient to aggregate my investments in the following way:

- A: UK single stocks, benchmarked against any dirt cheap FTSE 100 ETF (FTSE 350 is probably a better benchmark but these ETFs tend to be more expensive).

- B: Long only investments: All ETFs (in both investment and trading accounts) and UK stocks, benchmarked against a cheap 60:40 fund. This is the type of top down asset allocation portfolio I deal with in my second book.

- C: Equity neutral: The ETFs in my trading account, plus the equity hedge. Benchmark is zero.

- D: Futures trading: Return from the futures contracts traded by my fully automated system. This is the type of portfolio I deal with in chapter 15 of my first book. Benchmarks are a similar fund run by my ex employers, or any CTA index of your choosing. The denominator of performance here is the notional capital at risk in my account.

- E: Trading account value: This is essentially everything in my trading account, and consists of equity neutral + futures trading. No relevant benchmark.

- F: Everything: Long only investments, plus futures hedge, plus futures trading. For the benchmark here again I use a cheap 60:40 fund, but I include the value of any cash included in my trading account, since if I wasn't trading I could invest this.

If you prefer maths, then the relationship to the first set of categories is:

A = 1.1

B = 1.1 + 1.2 + 2.1

C = 2.1 + 2.2

D = 2.3

E = 2.1 + 2.2 + 2.3 = C + D

F = 1.1 + 1.2 + 2.1 + 2.2 + 2.3 + 2.4 = B + 2.2 + D + 2.4

I include this to point out that in many cases you can't just 'add-up the figures included here across categories.

UK Stocks portfolio

My UK stock investments have been in a period of transition for the last few years. The goal is to run these fully systematically (though not in an automated fashion), with all assets held in tax free accounts so that capital gains tax does not eat up returns. The system I use is described in this post I wrote here; with the twist that I now enforce industry diversification. It is in fact very similar to the list of filters I describe in chapter 11 on equity investing in my second book; with the addition of a stop-loss / momentum selling rule.

However there are some legacy issues, in particular I have a couple of large positions which I've been tactically reducing my exposure to (to maximise the use of capital gains allowances).

Anyway enough of a preamble, here are the numbers as a % of initial capital value:

Dividends: 5.8%

Mark to market: 12.0%

Total return: 17.8%

As with previous years the total return figure is misleading as I was a net seller of UK stocks; calculating the IRR I get 18.3%. This compares extremely well with the benchmark which came in at 2.2% (don't get excited - this is probably the high point of this post!).

I've actually outperformed the FTSE with my UK stock picking over each of the last 4 years; this is nowhere near a statistically significant record (and I'm pretty sure that ) but it does give you pause for thought. I'll come back to that thought later.

I owned 13 UK stocks at some point during the year (starting and ending with 10 stocks, three of which were replaced according to the systems rules (KIE, MARS and PFC). The other trades I did were further top slicing of the large position in STOB. Stellar performers were ICP, RMG, BKG and STOB (all of which earned over 25% measured with simple total return); whilst all the stocks I sold ended badly down (partly reflecting the stop loss which meant they were sold on a loss, but also reflecting the fact they didn't sharply recover by year end making me look like an idiot).

Current holdings then are:

ICP 18.8%

STOB 17.1%

BKG 10.4%

VSVS 9.5%

RMG 8.9%

LGEN 7.6%

GOG 7.5%

HSBA 7.4%

IBST 6.9%

BP 6.0%

The relatively large positions in ICP and STOB are historic rather than deliberate; further tactical top slicing should reduce these when tax allowances allow.

Long only investment portfolio

My long only investment portfolio as a whole (which includes the UK shares above, plus ETFs regardless of which account they are in or whether they are hedged) is constructed according to the principals in "Smart Portfolios".

The results here aren't quite as impressive:

Dividends: 4.4%

Mark to market: -3.1%

Total return: 1.3%

IRR: 1.33%

Benchmark: 1.31%

I know for a fact many people are thinking I would have been better off in Bitcoin. Clearly the ETF part of my portfolio dragged down the equity performance (UK equities are roughly 20% of my overall long only investment portfolio).

I was a small net seller of UK stocks, but a net buyer of ETFs (with some net buying overall as I was able to reinvest some additional capital). Generally I was a seller of bonds and a buyer of equities, as discussed last year the asset allocation model I use looks at 12 month momentum to tilt between bonds and equities (this is in part three of my second book). I noted in the previous update that equities were outperforming bonds, so a tilt towards equities away from my strategic allocation is warranted.

Right now MSCI world equities are up around 16% over one year, versus global bonds down around 1.8% so this pattern is unchanged.

I won't look at the current make up or risk exposure of my ETF portfolio just yet, since it only makes sense holistically including the equity hedge.

Trading account

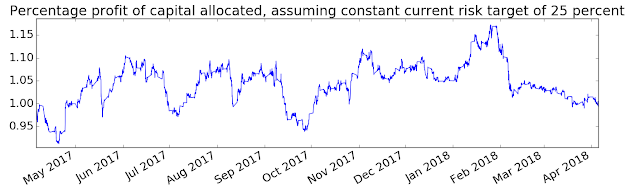

Although the make up of my trading account is complex I only have nice graphs that show the value of everything in it, so here they are:

|

| Since inception |

|

| Last 12 months |

The good news is I reached a new HWM in February; the bad news is that like the rest of the CTA universe I then got hammered and ended up flat for the year.

And here is the breakdown (all values normalised by my notional capital at risk):

ETFs

Mark to market: 0.1%

Dividends 3.7%

Commissions: -0.00%

Subtotal: 3.8%

Hedge

Mark to market: 0.25%

Commissions: -0.00%

Subtotal: 0.25%

Total for stocks and hedge: 4.1%

Futures

Gross profit: 0.48%

Commissions: -0.77%

Slippage: -0.47% (Bid ask spread cost -0.91%, less execution algo profit 0.43%)

Interest and fees: -0.09%

FX adjustments: -2.8%

Total for futures: -3.7%

Grand total: 0.4%

These FX losses are essentially the MTM of non GBP cash held in my futures account. Some of this cash is required for initial margin; if I didn't have this then I'd pay interest to borrow foreign currency which seems nuts. However there is also some excess cash, not required for margin. I took the decision not to 'sweep' this cash regularly back into GBP, as a proper hedge fund would do, which would minimise account volatility. Ultimately I'd rather have diversified currency holdings, although there is no right answer to this argument. In the long run I essentially view these FX gains and losses as noise with an expected zero mean.

Commissions and slippage are in line with backtest and previous years.

Some return statistics:

Standard deviation of returns (based on weekly, annualised): 23.8% versus long term target 25%

Average drawdown: 6.3%

Max drawdown: -17.2%

Worst day: -5.7%

Best day: +6.7%

Some trade statistics:

Profit factor: 0.98

Percent wins: 41.4%

Win/loss ratio: 1.5

Average holding period, winning trades: 32 days

......................................, losing trades: 21 days

It's probably instructive to review this performance in the context of the last few years, including some benchmark figures. 'Bench1' is this AHL fund, using monthly returns from April to March in each year, and a new benchmark 'Bench2' is the SG CTA index. Both have returns scaled up to match my volatility. Remember the benchmark should only be compared against futures trading, not the equity neutral component of the portfolio. Also note that the 'Bench1' fund has an explicit GBP hedge; so won't be as careless with cash exposure as I have been.

Year: 14/15 15/16 16/17 17/18

Hedge: -1.1%, 16.3%, 14.4%, 4.1%

Futures: 58.2%, 23.2%, -14.0%, -3.7%

Net: 57.2%, 39.6%, 0.3%, 0.4%

Bench1: 106.9%, -10.6%, -6.2%, 16.4%

Bench2: -6.7%*,-21.9%, -3.8%

* From 13th April 2015

So for this year at least I'm roughly in line with the CTA index, but behind the better performing AHL fund. This is a similar pattern to last year.

From another point of view my Sharpe Ratio since inception is still running at around 0.98; whilst for the AHL benchmark over the same period it's 0.86 (without risk free rate). None of these figures are statistically significant; and I personally couldn't care less whether I outperform or not, but it's still interesting to look at these figures occasionally (though annually is probably enough - I don't miss the days when institutional pressure meant I had to check in on competitor performance on a monthly basis or even more frequently!).

Digging more deeply it looks like the winning sectors were Volatility and bonds; with losses in FX and Energy. On an individual instrument level gainers were: Palladium, BTP, VSTOXX and Nasdaq and losers: Soybeans, Gas, Korean 3 year bonds and JPYUSD.

Let's look at the good news first; here is Palladium:

Classic picture of a long up trend which we ride until it finishes. After that the signal isn't strong enough to warrant a position. Interestingly Gold was not a profitable market this year, showing the advantages of intra sector diversification. Now for Italian BTP bonds:

A more nuanced example here; the system basically benefits from two clear uptrends each lasting a matter of weeks, and then bides its time in between. VSTOXX is particularly interesting:

The price shows a gradual downward trend; partly due to the rolldown effect that is particularly pronounced in vol markets; and also because vol levels did decline to very low levels (as I discussed at the time). Then in February there was a pronounced spike in vol that took a lot of people by surprise. Because I prefer to stay at least two months out in the contract space I didn't see such a sharp rise in price levels as in 'spot' implied vol, but it's also clear that I didn't have any position on between October and March, and thus avoided the spike entirely.

What gives? Well basically I ran out of margin head room, and because VIX and V2X were very margin hungry I closed my positions in them. So a bit of luck there.

Now the bad news. Soybeans:

Classic stuff where a choppy market results in gradual losses as we get whipsawed like crazy. The other losing markets show similar pictures so I won't bore you.

Holistic view of overall performance

Looking at my entire portfolio the raw numbers come in like this (dividing by a total for assets that includes cash held in my futures and other investment accounts):

Dividends: 4.1%

Mark to market: -3.5%

Total return: 0.56%

.... of which UK stocks: 3.3%

.... of which ETFs: -2.0%

.... of which futures + hedge p&l: -0.65%

IRR: 0.6%

Benchmark: 1.31%

This is a similar picture to last year: a slight under-performance against the benchmark.

Risk exposures

Here are my current cash weights across the entire portfolio:

Bonds: 25.1%

Equities: 65.3%

Other: 3.3% (property & gold)

Cash: 6.4%

Unlike last year the figures here already show the rebalancing I did at year end; as I already mentioned this included a further reallocation away from underperforming bonds to equities.

I prefer to look at risk allocations, which are (with last year in brackets) and [my strategic target allocations in square brackets]:

Bonds: 13.1% (17%) [25%]

Equities: 59.4% (54%) [50%]

Other: 2.9% (3%) [3%]

Futures*: 24.5% (26%) [22%]

* Trading, futures hedge offsets equities exposure

Asia EM Euro UK US Other

Bonds 0.0% 25.7% 27.8% 4.4% 33.7% 8.4%

Equity 13.5% 27.4% 20.5% 28.8% 9.3% 0.5%

Some thoughts

It would be nice to make more money, so an interesting question is how? Without digging too deep it looks like my systematic UK equity trading is doing relatively okay, and my futures trading could be better. This leads one to ask a number of questions.

Does the apparent out performance of my UK equities warrant a higher allocation than a Smart Portfolios investor would give it? To put it another way what is the benefit of a long only systematic portfolio exposed to multiple risk factors, versus vanilla market cap weighted? There is some benefit, but in my book I recommend not adjusting portfolio weights too much in the expectation of higher relative Sharpe Ratio. Indeed I'm currently at around 17% of total portfolio risk in UK equities, versus the 4% or so I recommend for a UK investor in my book. If I continue to top slice my outsized positions in ICP and STOB I will still only get down to 15%. In conclusion I think it is worth continuing to tactically reduce my UK equities exposure.

Improving my futures trading is something on the 'to-do' list. Arguably it would make more sense to introduce another asset class; perhaps cover more individual equities, start a long:short portfolio, or look into options. However this will involve far more work than I'm prepared to do so I'm sticking to futures. At some point when I get pysystemtrade to the point where it can replace my current trading system I will be in a position to start looking at some improvements here.