Lots of things have changed in the last year. Many unthinkable things are now thinkable. A war in Europe. The UK coming 2nd in the Eurovision song contest rather than the usual dismal 'null points'. And of course, the correlation of stocks and bonds has recently gone more positive than it has been for over 20 years:

I thought it would be 'fun' to see how the optimal stock/bond portfolio is affected by correlation and expected return assumptions.

In my second book, Smart Portfolios, I noted that a 100% equity portfolio made no sense under the Kelly criteria (AKA maximising CAGR), and that pretty much everyone should have some exposure to bonds regardless of their risk tolerance, even though they will have a lower expected arithmetic return due to their lower risk. For a while my own strategic risk weighting has been 10% in bonds, equating to cash weights of around 80/20.

I am currently reviewing my long only portfolio and it seems as good a time as any to check that 80/20 still makes sense.

Simple python code is liberally scattered throughout.

Assumptions and base case

I'm assuming a two asset, fully invested portfolio with two assets: a global stock, and a global bond (including both government and corporates). Both assets are Gaussian normal and have a linear relationship, so I can use an approximation for geometric return.

I assume that the standard deviation of the stocks is around 20% and the bonds around 10% (it's gone up recently, can't think why). Furthermore, I assume that my central case for the expected return in stocks is around 8%, and 5% in bonds. That corresponds to a simple SR (without risk free rate) of 0.4 and 0.5 respectively; eg a SR advantage for bonds versus the average SR of 0.05.

(Real return expectations are taken from AQR plus an assumed 3% inflation)

My utility function is to maximise real CAGR, which in itself implies I will be fully invested. Note that means I will be at 'full Kelly' - something that isn't usually advised. However we're determining allocations here, not leverage, so it's probably not as dangerous as you might think.

import numpy as np

import pandas as pd

def calculate_cagr(

correlation, equity_weight, mean_eq, mean_bo, stdev_eq=0.2, stdev_bo=0.1

):

bond_weight = 1 - equity_weight

mean_return = (equity_weight * mean_eq) + (bond_weight * mean_bo)

variance = (

((equity_weight**2) * (stdev_eq**2))

+ ((bond_weight**2) * (stdev_bo**2))

+ 2 * bond_weight * equity_weight * stdev_bo * stdev_eq * correlation

)

approx_cagr = mean_return - 0.5 * variance

return approx_cagr

Effect of correlation varying with base case assumptions

I'm going to vary the correlation between stocks and bonds, between -0.8 and +0.8

list_of_weight_indices = list(np.arange(0, 1, 0.001))def iterate_cagr(correlation, mean_eq, mean_bo):

cagr_list = [

calculate_cagr(

correlation=correlation,

equity_weight=equity_weight,

mean_bo=mean_bo,

mean_eq=mean_eq,

)

for equity_weight in list_of_weight_indices

]

return cagr_list

corr_list = list(np.arange(-0.8, 0.8, 0.1))

corr_list = [round(x, 1) for x in corr_list]

## plot correlation varying

results = dict(

[(correlation, iterate_cagr(correlation, 0.08, 0.05)) for correlation in corr_list]

)

results = pd.DataFrame(results)

results.columns = corr_list

results.index = list_of_weight_indicesresults.plot()def weight_with_max_cagr(correlation, mean_eq, mean_bo):

cagr_list = iterate_cagr(correlation, mean_eq, mean_bo)

max_cagr = np.max(cagr_list)

index_of_max = cagr_list.index(max_cagr)

wt_of_max = list_of_weight_indices[index_of_max]

return wt_of_max

results = pd.Series(

[weight_with_max_cagr(correlation, 0.08, 0.05) for correlation in corr_list],

index=corr_list,

)

Effect of SR varying

def means_from_sr_diff(sr_diff, avg_sr=0.45, stdev_eq=0.2, stdev_bo=0.1):

## higher sr_diff is better for equities

sr_eq = avg_sr + sr_diff

sr_bo = avg_sr - sr_diff

mean_eq = sr_eq * stdev_eq

mean_bo = sr_bo * stdev_bo

return mean_eq, mean_bo

def weight_with_max_cagr_given_sr_diff(correlation, sr_diff):

mean_eq, mean_bo = means_from_sr_diff(sr_diff)

return weight_with_max_cagr(correlation, mean_eq, mean_bo)

# fix corr at zero

sr_diff_list = list(np.arange(-0.5, 0.5, 0.01))

results = pd.Series(

[weight_with_max_cagr_given_sr_diff(0, sr_diff) for sr_diff in sr_diff_list],

index=sr_diff_list,

)

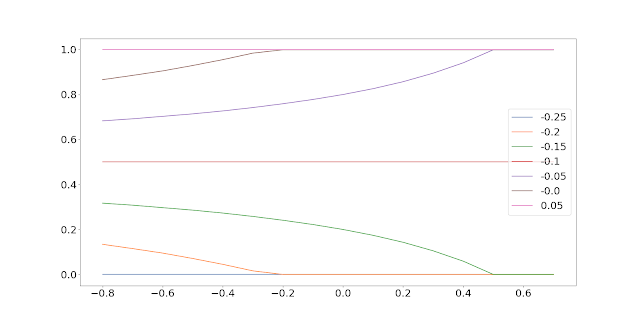

Effect of SR and correlations varying

sr_diff_list = list(np.arange(-0.25, 0.0501, 0.05))

sr_diff_list = [sr_diff.round(2) for sr_diff in sr_diff_list]

results = pd.DataFrame(

dict(

[

(

correlation,

[

weight_with_max_cagr_given_sr_diff(correlation, sr_diff)

for sr_diff in sr_diff_list

],

)

for correlation in corr_list

]

)

)

results.index = sr_diff_list

results.columns = corr_listresults = results.transpose()

results.plot()Sensitivity

results = []

for correlation in [-0.4, 0, 0.4]:

for sr_diff in [-0.25, 0, 0.25]:

cagr80 = cagr_with_sr_diff(0.8, correlation, sr_diff)

cagr90 = cagr_with_sr_diff(0.9, correlation, sr_diff)

cagr100 = cagr_with_sr_diff(1, correlation, sr_diff)

loss80 = cagr100 - cagr80

loss90 = cagr100 - cagr90

results.append(

dict(

correlation=correlation,

sr_diff=sr_diff,

cagr100=round(cagr100 * 100, 1),

cagr90=round(cagr90 * 100, 1),

cagr80=round(cagr80 * 100, 1),

loss80=round(loss80 * 100, 2),

loss90=round(loss90 * 100, 2),

)

)

print(pd.DataFrame(results))

correlation sr_diff cagr100 cagr90 cagr80 loss80 loss90

0 -0.4 -0.25 2.0 2.7 3.4 -1.43 -0.75

1 -0.4 0.00 7.0 7.0 6.9 0.07 0.00

2 -0.4 0.25 12.0 11.2 10.4 1.57 0.75

3 0.0 -0.25 2.0 2.7 3.3 -1.30 -0.68

4 0.0 0.00 7.0 6.9 6.8 0.20 0.07

5 0.0 0.25 12.0 11.2 10.3 1.70 0.82

6 0.4 -0.25 2.0 2.6 3.2 -1.17 -0.60

7 0.4 0.00 7.0 6.9 6.7 0.33 0.15

8 0.4 0.25 12.0 11.1 10.2 1.83 0.90

This makes sense if only stocks and bonds are part of your investment universe. But if correlations have risen (and you're saying implicitly that they're expected to stay high) couldn't you consider other assets that could be part of a diversified portfolio (gold, commodities, inflation-linked bonds etc)?

ReplyDeleteOh sure but it's hard to draw these pretty plots with more than two assets. For a longer answer to your question, https://www.aqr.com/About-Us/News/2022/Press-Release or https://www.systematicmoney.org/smart

DeleteI'm sure you have considered a levered stocks/bonds/commodities risk parity allocation as an alternative to a mostly equity based portfolio. What are the reasons you went with the second solution? I guess one factor could be you don't want to use leverage since you already use it in your futures strategy?

DeleteThat's part of it. Also, about half my investments are in tax sheltered accounts where I can't trade futures. I also find it psychologically easier to use dividends from long only investments as income, rather than withdrawing from a futures account.

Delete